|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

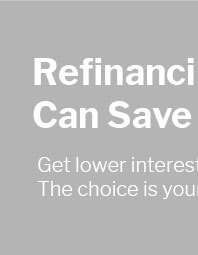

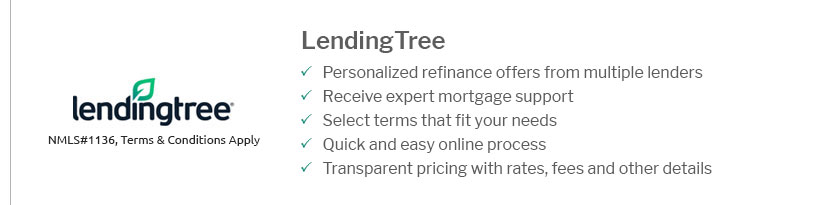

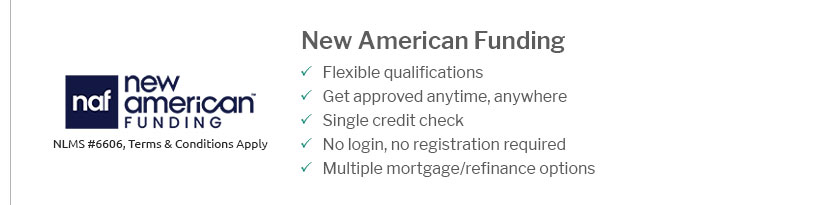

Understanding Cash Out Refinance Near Me: A Comprehensive GuideWhen considering a cash-out refinance, finding the best options near you can make a significant difference in your financial outcome. This guide will help you navigate through the process, providing valuable insights into what to expect and how to choose the right lender. What is Cash Out Refinance?A cash-out refinance involves replacing your current mortgage with a new one, while also borrowing additional money against the equity in your home. This can be an effective way to access funds for home improvements, debt consolidation, or other financial needs. Benefits of Cash Out Refinance

Finding Cash Out Refinance Options Near YouLocal lenders often offer personalized services and a better understanding of the regional market, which can be beneficial when seeking a cash-out refinance. Consider visiting fha loan usa for more detailed options available to you. Steps to Find a Lender

Common ConsiderationsBefore committing to a cash-out refinance, consider the long-term implications. Evaluate your financial goals, and ensure that this step aligns with them. Interest Rates and TermsExplore options like a 30 yr fixed mortgage to understand different repayment terms and how they might affect your financial strategy. Frequently Asked QuestionsWhat are the risks of a cash-out refinance?The main risks include potentially higher interest rates, increased loan amounts, and the possibility of losing your home if you fail to meet payment obligations. How much can I borrow with a cash-out refinance?The amount you can borrow typically depends on your home’s equity, your credit score, and the lender’s policies. Generally, lenders allow you to borrow up to 80% of your home’s value. Is cash-out refinancing a good idea?Cash-out refinancing can be a good idea if you need funds for a specific purpose and are confident you can handle the new loan terms. Always weigh the benefits against the potential risks. https://www.chase.com/personal/mortgage/refinance/home-equity

Refinance. Refinance your existing mortgage to lower your monthly payments, pay off your loan sooner, or access cash for a large purchase. Use our home value ... https://dashhomeloans.com/virginia/refinance/cash-out-refinance/

Sign me up! But as with all good things, there's a catch. Though a cash-out refinance lets homeowners tap into their hard-earned equity, it's risky. If you can ... https://www.vacu.org/loans/home-loans/home-refinance

Refinance to lower your monthly payments, change the term of your mortgage, or get cash out to use for a home project or other expense.

|

|---|